Заказать ткань для пошива одежды – это первый и один из самых важных шагов

Индивидуальные металлические значки являются превосходным способом выделиться из толпы и придать вашему мероприятию, бренду

Переработка лома алюминия начинается с его сбора, сортировки по типам и очистки от загрязнений.

В этой статье мы рассмотрим, какие меры необходимо предпринять для эффективной охраны вашего товарного

Выбор петличного микрофона – это решение, которое может кардинально изменить качество аудиодорожки ваших видеоматериалов.

Эти арт-встречи привлекают людей, которые не обязательно имеют опыт в живописи, но желают попробовать

Замена дверных замков - эффективный и необходимый шаг для обеспечения безопасности вашего дома или

Преобразование женского пуховика с течением времени отражает изменения в модных тенденциях и технологиях производства.

Использование виниловых надписей позволяет не только выразить личные предпочтения, но и создать определенное настроение

В современном цифровом мире Телеграм выступает не только как платформа для общения, но и

Поддержание водно-солевого баланса в организме человека является одним из основополагающих аспектов поддержания здоровья и

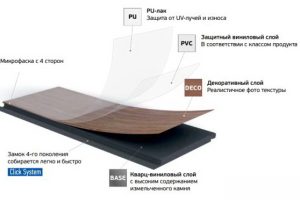

SPC ламинат Фарго - это инновационный тип напольного покрытия, который сочетает в себе лучшие

Футбол имеет богатую историю, которая начинается еще в средние века. Современный вид игры начал

Танец – это искусство, которое не знает границ. Он может быть выражением чувств, способом

Военно-полевая кухня – это мобильное устройство, предназначенное для приготовления пищи в условиях, где нет

Обучение в J-center Studio ведется в соответствии с высокими стандартами, что гарантирует качественную подготовку

Рыбалка - это не только увлекательное хобби, но и искусство, требующее правильного подхода и

Давайте продолжать исследовать кулинарное наследие мира и радовать себя и близких уникальными блюдами из

Сервисы, такие как аренда аттракционов, предлагают удобный и гибкий способ привнести атмосферу праздника в

На первый взгляд квадроциклы и квадрициклы могут показаться очень похожими, однако между этими двумя

Дистанционное образование, ставшее особенно актуальным в последнее десятилетие, революционизировало подход к обучению и доступу

Букет невесты «Алмазная Россыпь» – это не просто аксессуар, а важный атрибут, подчеркивающий красоту

Современные рюкзаки изготавливаются из высококачественных материалов, обеспечивающих долговечность и надежность.

Обменники валюты играют ключевую роль в международных путешествиях и глобальной экономике, обеспечивая удобный доступ

Детская стоматология отличается от взрослой особой акцентированностью на комфорт и психологический аспект взаимодействия с

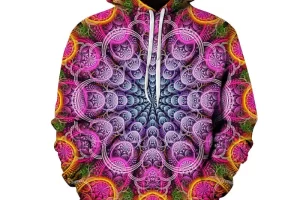

Толстовки с принтами на заказ стали важным элементом современной моды, предоставляя возможность выразить свою

IT-курсы предлагают актуальные знания и практические навыки, которые необходимы для успешной карьеры в этой

Перевозка инвалидов – это важная часть обеспечения их мобильности и независимости. Это требует особого

Корейская кухня предлагает широкий выбор блюд, начиная от знаменитого кимчи (ферментированной капусты) и заканчивая

Ювелирный ломбард представляет собой специализированное учреждение, где вы можете быстро получить денежные средства под